Budget announces some much-needed reforms!

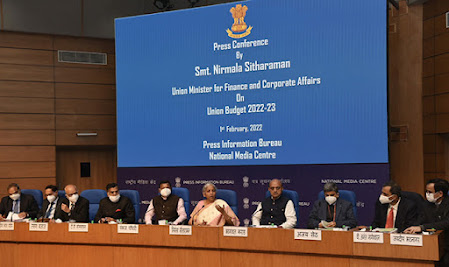

On the way to attain global GJ Hub stature! To help gold jewellery exports The Gem & Jewellery Export Promotion Council (GJEPC), congratulates the Government of India and the honourable Finance Minister Nirmala Sitharaman for presenting a strong pro-reform and export growth-oriented Union Budget under the visionary leadership of our honourable Prime Minister Narendra Modi. The gem and jewellery (GJ) sector in India is overwhelmed by the Government support extended to the gem and jewellery industry in the Union Budget 2022-23. There is a swathe of favourable policy reforms announced that empowers the industry and puts it on a firm footing to capitalise on growth opportunities in the coming decade. The Indian gem & jewellery sector is one of the leading contributors to the national economy and the country is the undisputed leader in diamond processing. GJEPC hopes to replicate this success in the jewellery vertical, too, and help India become the ‘Jewe...