Lucara Q1 sales 80,295 carats of diamonds!

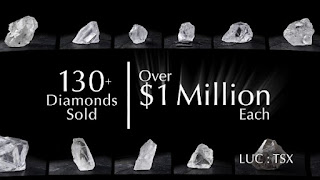

An average price per carat grew to $690 from $480 YoY Lucara Diamond Corporation reports its results for the quarter ended March 31, Q1 2022 said, Lucara revenue in Q1 2022 increased by 28% to $68.2 million from $53.1 million in Q1 2021 a reflection of strong rough and polished diamond market fundamentals into the first quarter. The combination of a strong diamond market, combined with the sale of several higher value rough diamonds in Q1 2022 generated an average price per carat (excluding top-up payments) of $690 for Karowe diamonds sold during the quarter (Q1 2021: $480 per carat). A total of 186 Specials (single diamonds in excess of 10.8 carats) were recovered, representing 6.9% weight percent Specials (Q1 2021: 6.8%). Sales volumes transacted on Clara during Q1 2022 totalled $7.0 million, a 17% increase from the $6.0 million in sales volume transacted in Q1 2021. A third-party producer will commence a series of trial sales beginning in Q2 of 2022. Eira ...