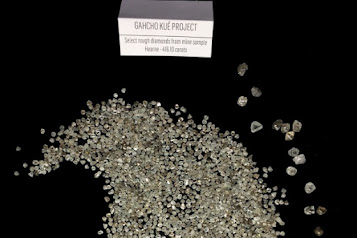

4,269 carats of rough diamonds earns US$6.6mn

Lulo get an average rough price of US$1,550 a carat Lucapa Diamond Company and its partners Endiama and Rosas & Petalas are announce the results from the latest sale of diamonds from the Lulo alluvial diamond mine in Angola, Sociedade Mineira Do Lulo. A total of 4,269 carats of Lulo diamonds sold for gross proceeds of US$6.6 million (A$9.0 million) on a 100% basis, representing an average price of US$1,550 (A$2,100)/ carat. Sales year to date amounts to US$28.0 million (A$40.1 million) from 20,397 carats at US$1,371 (A$1,967)/ Carat. Lucapa is a niche diamond producer with high-value mines in Angola (Lulo) and Lesotho (Mothae). The Lulo alluvial mine and Mothae kimberlite mine both produce large and high-value diamonds, with >75% of revenues generated from the recovery of +4.8 carat stones. Lulo has produced 15 +100 carat diamonds to date and is one of the highest average US$ per carat alluvial diamond producers in the world. Lucapa and its Project Lulo partners hav