Asanko sales 41,929 ounces of gold in Q1 2022

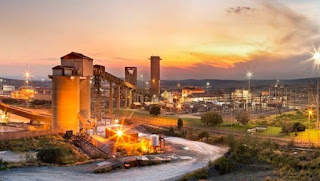

An average AGM realized gold price of $1,846/oz Galiano Gold Inc reports first quarter (Q1) operating and financial results for the Company and the Asanko Gold Mine (AGM). Asanko Gold Mine Key Metrics (100% basis)are, Gold production of 42,343 ounces, in line with 2022 production guidance of 100,000- 120,000 ounces of gold. Total cash costs per ounce1 of $1,361 and all-in sustaining costs1 of $1,559/oz during the quarter, resulting in positive cash flows from operations of $3.9 million and AISC margin1 of $12.0 million. The AGM produced 42,343 ounces of gold during the quarter, as the processing plant achieved milling throughput of 1.5Mt of ore processed at a grade of 1.3g/t with metallurgical recovery averaging 69%. Sold 41,929 ounces of gold in Q1 2022 at an average realized gold price of $1,846/oz for total revenue of $77.5 million (including $0.1 million of by-product silver revenue), a decrease of $33.3 million from Q1 2021. The decrease in revenue quarter-on-quarter was a fu...