AngloGold cost improved!

1Q

Gold Production was 752K oz!

Started

a process to review divestment!

AngloGold

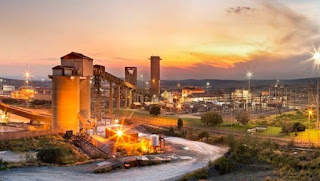

Ashanti said costs improved in the first quarter and all aspects of full-year

guidance remained on track, as the Company started a process to review

divestment options for its South African assets. Production for the three

months ended 31 March 2019 was 752,000oz at an average total cash cost of

$791/oz, compared to 824,000oz at $834/oz during the first quarter of last

year.

All-in

sustaining costs from these operations fell 2% to $1,009/oz over the same

period. The company delivered a solid Adjusted EBITDA margin of 37%, despite a

lower gold price and marginally lower production from certain assets, which it had

flagged earlier in February.

AngloGold

Ashanti is streamlining its portfolio to ensure greater management focus and to

concentrate its capital on projects delivering the highest returns. The

Company, which said it started a process to review divestment options for its

South African assets, already has processes underway to find buyers for its

holdings in the Cerro Vanguardia mine, in Argentina and the Sadiola mine, in

Mali.

“Our

priorities are to safely improve margins, and to ensure we increase long-term

value for our stakeholders,” Chief Executive Officer Kelvin Dushnisky said.

“We’re working hard on both fronts - driving fundamental cost improvements

through investment and efficiency initiatives, and ensuring we have a

fit-for-purpose portfolio.”

“Our

priorities are to safely improve margins, and to ensure we increase long-term

value for our stakeholders,” Chief Executive Officer Kelvin Dushnisky said.

“We’re working hard on both fronts - driving fundamental cost improvements

through investment and efficiency initiatives, and ensuring we have a

fit-for-purpose portfolio.”

Key

projects remain on track and within budget. Obuasi remains the main area of

growth development focus for this year as the Company works towards its first

gold pour at the end of 2019. The Siguiri Combination Plant is currently

ramping up towards full production in June.

At

Tropicana in Australia, decline development at Boston Shaker is about to

commence with mining of the first stop expected in August 2020. The Company has

also announced its decision to further streamline the portfolio through a process

to review the divestment options of its South African assets aimed to ensure

that the value and future prospects of these assets are maximised.

This

is in line with AngloGold Ashanti’s ongoing review of its portfolio and a

disciplined capital allocation approach to ensure it generates maximum value

for all its stakeholders. The full-year guidance remains unchanged as follows:

1: Production between 3.25Moz to 3.45Moz; 2: Total cash costs between $730/oz

and $780/oz.

3:

AISC between $935/oz and $995/oz, assuming average exchange rates against the US

Dollar of ZAR 14.00 (South African Rand), BRL 3.65 (Brazilian Real), AUD 0.75 (Australian

Dollar) and ARS 40.00 (Argentinian Peso), with the Brent crude oil price at $74/bl

average for the year; and 4: Capital expenditure anticipated to be between

$910m and $990m.

Comments

Post a Comment