Aggravate financing challenges!

Elevated

Financing Risks for Corporates

The

cost of financing could remain elevated

Expected

a gross borrowing of INR6.47tn in FY19

According

to Arindam Som, Analyst & Soumyajit Niyogi, Associate Director of IndRa, a

sustained tightening of monetary condition coupled with challenging external

environment is likely to aggravate financing challenges for Indian corporates

against the backdrop of not-so-benign domestic credit market, says India

Ratings and Research (Ind-Ra).

The

agency previously highlighted that corporate credit spreads are likely to widen

owing to the pressure on capital account in an environment of twin deficit,

i.e. combined fiscal and current account deficit. An analysis of the top 500

debt-heavy corporates indicates that a gross borrowing of INR6.47 trillion

(including refinancing) is expected in FY19.

The

agency previously highlighted that corporate credit spreads are likely to widen

owing to the pressure on capital account in an environment of twin deficit,

i.e. combined fiscal and current account deficit. An analysis of the top 500

debt-heavy corporates indicates that a gross borrowing of INR6.47 trillion

(including refinancing) is expected in FY19.

Amid

challenges over sustenance of emerging markets’ foreign portfolio flows, a

visible weakness in net domestic household savings rate, declining mutual

funds’ debt assets under management, and the inability of public sector banks

to support credit growth, corporates may face headwinds in raising additional

funds. Therefore, the agency believes the cost of financing could remain

elevated.

Of

the total INR6.47 trillion in FY19, the agency expects around 40% of the gross

borrowings to be attributable to refinancing requirements, 20% for working

capital requirements and the rest for growth and maintenance capex. Of the

total borrowing requirement, approximately 65% is likely to be attributable to

Investment grade rated corporates.

The

total net debt for the top 500 corporates is likely to increase by INR3.72

trillion in FY19 & thereby accounting for nearly 32% of the incremental

credit demand. At an aggregate level, the agency estimates that direct lending

by Indian banks accounted for around 60% of the credit supply in the economy in

FY18.

Of

the total demand for capex, Ind-Ra expects around 55% to be driven by

maintenance capex while a large portion of the working capital borrowings are

likely to be attributed to the dual impact of a rise in commodity prices

through FY19 and a weakening INR against the USD.

Therefore,

only 15%-20% of the credit demand is likely to be discretionary. Given the high

proportion of non-discretionary borrowings, the agency opines that inability to

tie up funding in a timely manner could result in substantial disruptions in

the day-to-day operations of these corporates and could give rise to clustered

credit events.

Majority

of the credit demand is likely to emanate from corporates with liquidity scores

between 1x and 1.5x. These corporates along with those below 1x liquidity score

are likely to account for nearly 89% of the gross borrowings of INR6.47

trillion in FY19. The share of such corporates in total borrowings in FY18

stood at 68%.

Ind-Ra

believes working capital related pressures driven by a weak rupee and rising

commodity prices are likely to put further pressure on the liquidity scores of

these corporates. Moreover, the agency believes the ability to pass on rising

material and financing cost will be limited, given multiple headwinds.

Inability to refinance their debt and/or secure working capital financing could

affect the overall operating and financial risk profile of these corporates.

Amid

an environment of rising inflationary expectations in developed economies,

especially in the US, coupled with unwinding of quantitative easing, India has

experienced a relative flattening of its benchmark G-Sec yield curve – with the

spread between the three-month YTM and 10 years YTM shrinking to 90bp, as of 24

October 2018, from143bp on 1 April 2018. Though open market operations by the

Reserve Bank of India in October 2018 have eased some of the pressure on

short-term rates, the Indian yield curve remains the flattest among other BBB

rated Asian emerging economies.

Over

the last few years, the share of short-term external debt as a proportion of

India’s exports has risen; while countries such as Philippines and Thailand

have continued to reduce the share of short-term external debt as a proportion

of their total exports.

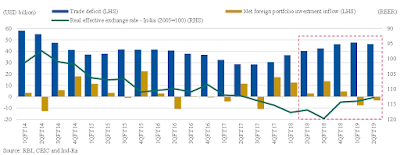

Through

1HFY19 credit growth to the export sector has continued to contract. This

coupled with an increase in the real effective exchange rate (REER) between

2QFY14-2QFY19, notwithstanding a slight recovery in 2QFY19, is likely to

impinge on the pace of recovery of Indian exports. Additionally, both the

direct and indirect impacts of tariff measures taken by the US are likely to

unfold in the coming days, which may not be conducive for Indian exports.

In

light of de-synchronised growth between US and rest of the World, coupled with

a contraction in the central banks’ balance sheet, the flow of credit is likely

to become more volatile – both in terms of quantum and cost – thereby affecting

demand conditions globally.

Comments

Post a Comment