Gold as a strategic asset

The

relevance of gold

is

no one’s liability

Recently

the World Gold Council has published, The relevance of gold as a strategic

asset (2019), from investment perspective. That says gold is a highly liquid

yet scarce asset, and it is no one’s liability. It is bought as a luxury good

as much as an investment. As such, gold can play four fundamental roles in a

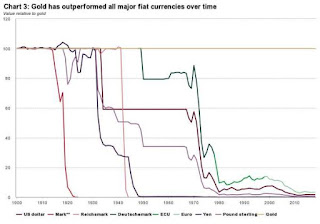

portfolio, 1: a source of

long-term returns, 2: a diversifier that can mitigate losses in times of market

stress, 3: a liquid asset with no credit risk that has outperformed fiat

currencies & 4: a means to enhance overall portfolio performance.

Our

analysis shows that adding 2%, 5% or 10% in gold over the past decade to the

average pension fund portfolio would have resulted in higher risk-adjusted

returns.

The

WGC says, Gold is becoming more mainstream. Since 2001, investment demand for

gold worldwide has grown, on average, 15% per year. This has been driven in

part by the advent of new ways to access the market, such as physical

gold-backed exchange-traded funds (ETFs), but also by the expansion of the

middle class in Asia and a renewed focus on effective risk management following

the 2008–2009 financial crisis in the US and Europe.

Today,

gold is more relevant than ever for institutional investors. While central

banks in developed markets are moving to normalise monetary policies – leading

to higher interest rates – we believe that investors may still feel the effects

of quantitative easing and the prolonged period of low interest rates for years

to come.

These

policies may have fundamentally altered what it means to manage portfolio risk

and could extend the time needed to meet investment objectives.

In

response, institutional investors have embraced alternatives to traditional

assets such as stocks and bonds. The share of non-traditional assets among

global pension funds has increased from 15% in 2007 to 25% in 2017. And in the US

this figure is close to 30%.

Many

investors are drawn to gold’s role as a diversifier – due to its low

correlation to most mainstream assets – and as a hedge against systemic risk

and strong stock market pullbacks. Some use it as a store of wealth and as an

inflation and currency hedge.

Comments

Post a Comment